Save up to 20% off the premium when you buy a 3-year Plan

-

Discount

-

Plan Duration

| Discount | Plan Duration |

| 10% premium discount | For 2-year plan |

| 20% premium discount | For 3-year plan |

| Discount |

| 10% premium discount |

| 20% premium discount |

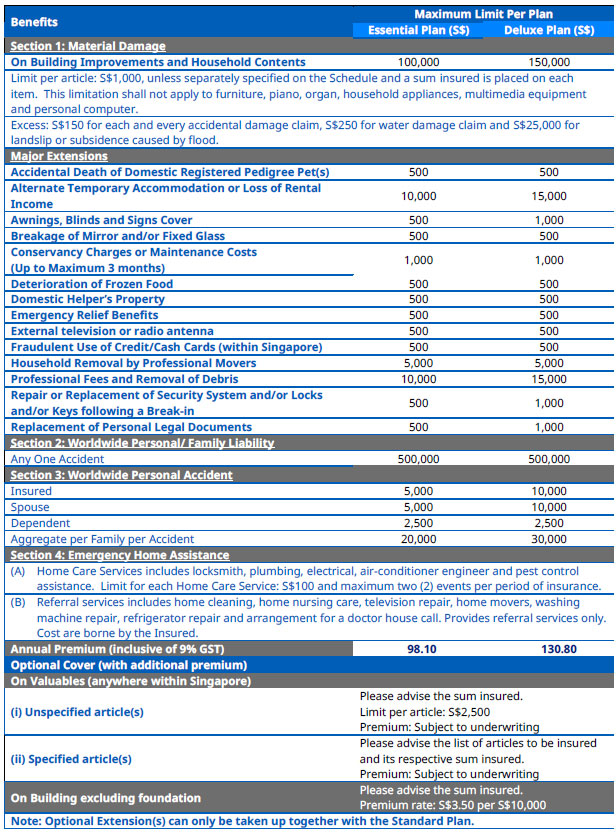

Coverage

To find out more about this product, please contact us at 6222 7733 or email us your enquiry to us for follow up.

Useful Information

Important Definitions

- Building Improvements shall include but not limited to interior renovation, decoration and fixtures, fittings and other additions made to the building such as built-in cabinets, wardrobes, air-conditioners and the likes.

- Household Contents refers to all contents of every description at the Situation stated in the Schedule which belong to the Insured (or for which Insured is legally responsible) or to Insured’s family member(s) who permanently reside with him, including the following:

- Cash and other negotiable securities, travel tickets, deeds, stamp collections, manuscripts, medals and coins, all whilst held for private purposes, to an amount of S$500.00 in total, unless individually insured and itemized and declared with a corresponding sum insured for each item listed in the Schedule,

- Valuable articles including curios, pictures or other works of art, furs, jewellery, jade, gemstones, watches, gold or silver objects, up to S$1,500.00 for any one item and the total value of such shall not exceed one-third (1/3) of the Total Sum Insured for Section 1 of the Schedule, whichever is the lesser, unless individually itemized and insured with a corresponding sum insured for each item listed in the Schedule.

- Any one article which value does not exceed S$1,000.00 unless specified on the Schedule and a sum insured is placed on each item. This limitation shall not apply to furniture, piano, organ, household appliances, multimedia equipment and personal computer.

But shall not include livestock, motor vehicles, motor cycles, caravans, trailers, boats, aircraft or their accessories whilst in them or on them.

- Building refers a private dwelling, residential flat or private boarding house and all domestic outbuildings, fixtures and fittings attached to the Building, in-ground swimming pool, underground services, walls, gates, and fences and all other domestic improvements of a structural nature excluding foundation at the Situation as stated in the Schedule and for which Insured is legally responsible. All Buildings are declared by the Insured to be built of brick, stone or concrete and roofed with concrete, slate, metal and other non-combustible mineral ingredients unless specially mentioned.

- Cash and other negotiable securities, travel tickets, credit cards, deeds, documents, stamp collections, manuscripts, medals and coins, all whilst held for private purposes, up to an amount of S$500 in total, unless separately specified in the Schedule and a sum insured placed on each item.

- Curios, pictures or other works of art, furs, jewellery, jade, gemstones, watches, gold or silver objects, up to a maximum any one item of S$1,000 or 5% of the sum insured on Household Contents, whichever is the greater, unless separately specified on the Schedule and a sum insured placed on each item.

But shall not include livestock, motor vehicles, motorcycles, caravans, trailers, boats, aircraft or their accessories whilst in them or on them.

Major Exclusions

This Policy generally does not cover:

- Wear and tear of the property or inherent vice and latent defects

- Faulty or defective design or workmanship

- War and kindred risks;

- Acts of terrorism;

For the full list of Exclusion, you can request a copy of the specimen policy from UOI.

FAQ

Who should purchase UOI Home Contents Insurance ?

It is recommended for homeowners or tenants of HDB, condominium or landed properties who want to protect the content of their home, or the renovation carried out for their home.

If I live in a condominium, does the Management Corporation's fire insurance cover home content?

In most cases, the condominium Management Corporation’s fire insurance covers only the building structure and common areas. It does not cover your household contents (including your furniture, fixtures and fittings) nor renovations inside your house. We recommend that you check the coverage and benefits of the fire insurance policy arranged by the Management Corporation.

I already have a fire insurance policy for my HDB flat. Do I still need UOI Home Contents Insurance?

The standard HDB fire insurance policy only covers the damage to the structure of your home.

We recommend that you should, at all times, maintain the HDB fire insurance policy or such similar coverage, and protect your home contents with UOI Home Contents Insurance. UOI Home Contents Insurance provides coverage for household contents, renovation, fixture and fittings

What’s the difference between mortgage insurance and UOI Home Contents Insurance?

Mortgage Insurance pays off your outstanding mortgage loans partially or in full if an unfortunate event (e.g. death or total permanent disability) takes place. On the other hand, UOI Home Contents Insurance provides coverage for household contents, renovation, fixture and fittings if the unexpected happens.

Are my household contents covered when my home is unoccupied?

Any loss or damage to your household contents will not be covered if the property is unoccupied for more than 60 days.

If I am moving to a new premise, what should I do with my UOI Home Contents Insurance policy?

You may call or email us to update your address to the new premises. There will be no administrative charge for the change in address.

I need to correct my particulars which I entered online. How do I go about it?

You can call us or email your request to personal-insurance@uoi.com.sg.

What will or will not be covered by UOI Home Contents Insurance?

UOI Home Contents Insurance will indemnify you against any unforeseen and sudden physical loss or damage to your household contents from any cause, other than those specifically excluded such as due to wear and tear, faulty design etc. For the full list of exclusions, you may refer to the Policy Wording.

Does UOI Home Contents Insurance cover valuables such as watches, rings etc. that I keep at home?

Both the Essential and Deluxe Plans cover valuables up to S$1,500 per article and total value of all the valuables shall not exceed 1/3 of the total sum insured for the respective plan, whichever is the lesser.

You can consider taking up the Optional Cover: Loss or Damage to Valuables to cover your valuables which exceed S$1,500 per article.

As this optional coverage is subject to insurer's underwriting, please contact us at 62227733 or email your request to personal-insurance@uoi.com.sg.

How do I go about insuring my Building?

You can consider taking up the Optional Cover: Loss or Damage to Building.

As this optional coverage is subject to insurer’s underwriting, please contact us at 62227733 or email your request to personal-insurance@uoi.com.sg.

How do I file a claim?

Call or email UOI’s Claims Division at claim@uoi.com.sg within thirty (30) days. Do preserve and/or take photographs of damaged items for claim purposes.